Dividend Growth Strategy

Learn how to build wealth by investing in companies that consistently increase their dividend payments year after year.

What is Dividend Growth Investing?

Dividend growth investing focuses on companies that not only pay dividends but have a consistent history of increasing those dividend payments over time. This strategy emphasizes quality businesses with sustainable competitive advantages that allow them to grow earnings and increase shareholder returns year after year.

Key Benefits

- Growing Income Stream - Your dividend income increases over time without adding new capital

- Inflation Protection - Dividend increases often outpace inflation, preserving purchasing power

- Quality Companies - Dividend growers tend to be stable, profitable businesses

- Lower Volatility - These stocks typically experience less price volatility than the broader market

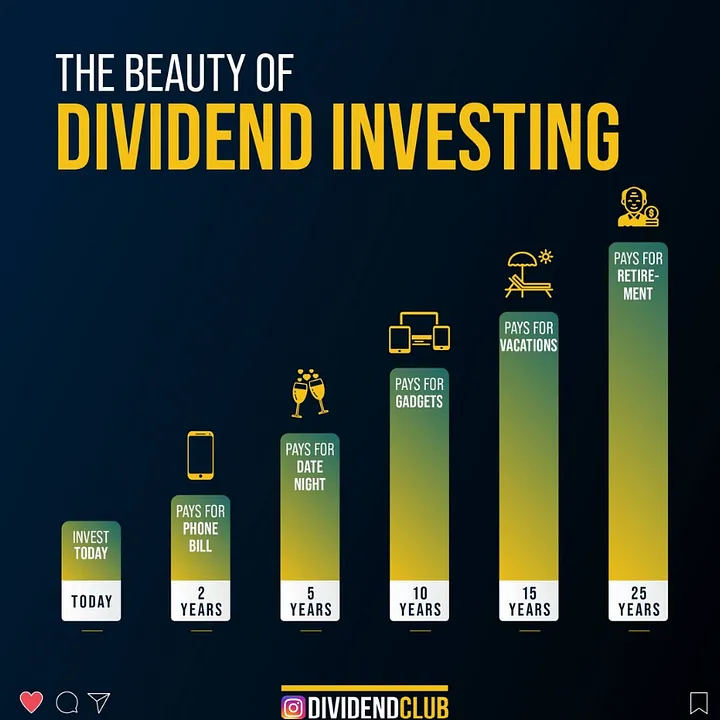

The Power of Dividend Growth

Example: The Compounding Effect

Consider an investor who purchases $10,000 worth of a stock with a 3% dividend yield that grows its dividend by 7% annually:

- Year 1: $300 in dividends (3% yield)

- Year 5: $394 in dividends (3.94% yield on original investment)

- Year 10: $552 in dividends (5.52% yield on original investment)

- Year 20: $1,086 in dividends (10.86% yield on original investment)

After 20 years, the investor is earning an effective 10.86% yield on their original investment through dividend growth alone!

Characteristics of Dividend Growth Companies

Strong Balance Sheets

Low debt levels and strong cash flow generation

Competitive Advantages

Durable business models with economic moats

Reasonable Payout Ratios

Typically 30-60% of earnings, allowing room for growth

Consistent Earnings Growth

Steady increases in revenue and profitability

Building Your Dividend Growth Portfolio

Research Dividend Aristocrats and Kings

Start with companies that have increased dividends for 25+ years (Aristocrats) or 50+ years (Kings).

Analyze Dividend Growth Rates

Look for companies with 5-10 year dividend growth rates that outpace inflation.

Evaluate Business Fundamentals

Assess competitive advantages, management quality, and industry trends.

Diversify Across Sectors

Build a portfolio with exposure to different industries to reduce risk.

Reinvest Dividends

Use dividend reinvestment plans (DRIPs) to compound your returns over time.

Ready to Start Your Dividend Growth Journey?

Use our tools to identify the best dividend growth stocks and calculate the potential of your dividend growth portfolio.